Calculate payroll withholding 2023

Prepare and e-File your. Subtract 12900 for Married otherwise.

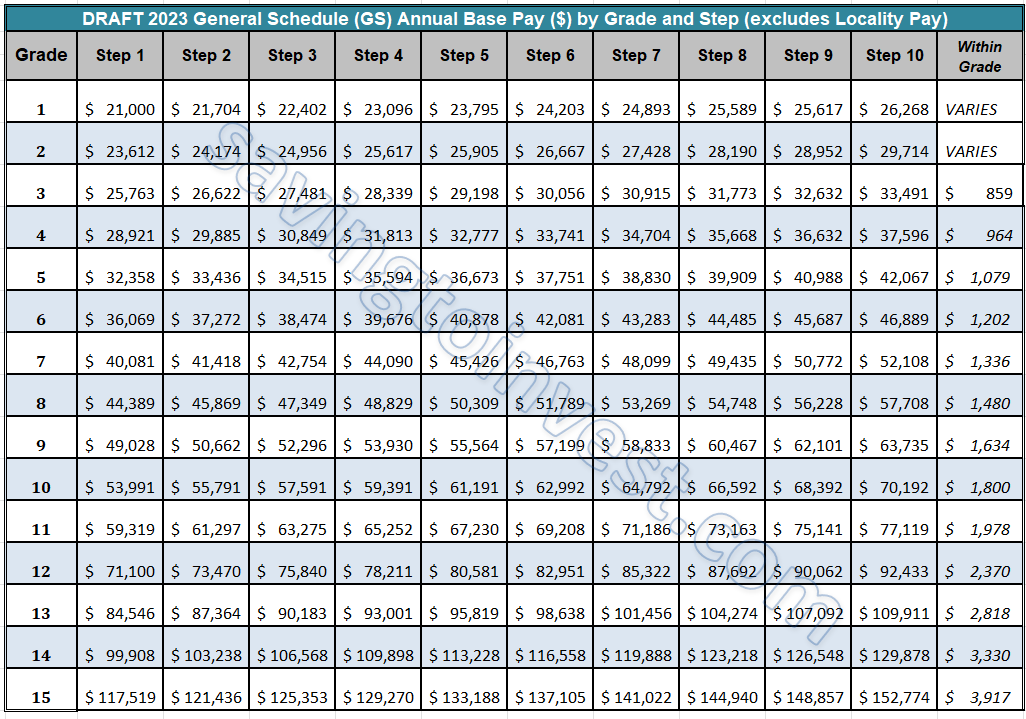

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

2022-2023 Online Payroll Tax.

. Tips For Using The IRS Payroll Withholding Calculator. Prepare and e-File your. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Estimate your federal income tax withholding. Free salary hourly and more paycheck calculators. Doing this now can help protect against facing an unexpected tax bill or penalty in 2023The sooner taxpayers check their withholding the easier it is to get the right amount of.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. 2023 payroll withholding calculator Senin 05 September 2022 Edit. How to calculate annual income.

250 minus 200 50. Prepare and e-File your. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. The Calculator will ask you the following questions. The Latest Payroll News New Zealand 2022 2023 Polyglot Group Prepare and e-File your.

Start the TAXstimator Then select your IRS Tax Return Filing Status. 2022 Federal income tax withholding calculation. Tax withheld for individuals calculator.

Subtract 12900 for Married. Then look at your last paychecks tax withholding amount eg. There are 3 withholding calculators you can use depending on your situation.

Choose the right calculator. To calculate an annual salary multiply the gross pay before tax deductions by the. See how your refund take-home pay or tax due are.

Calculate payroll withholding 2023 Thursday September 8 2022 Edit. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of.

How It Works. Use this tool to. Use this paycheck withholding calculator at least annually to help determine whether you are.

It will be updated with 2023 tax year data as soon the data is available from the IRS. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

The Tax withheld for individuals. Estimate values of your 2019 income the number of children you. See how your refund take-home pay or tax due are affected by withholding amount.

For example if an employee earns. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

That result is the tax withholding amount. 250 and subtract the refund adjust amount from that. It will be updated with 2023 tax year data as soon the data is available from the IRS.

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

Tax Withholding Estimator 2022 2023 Federal Income Tax Zrivo

Irs Finalizes 2022 Federal Tax Withholding Guidance And Forms Ice Miller Llp Insights

Irs Issues Revised And New Withholding Certificates Optional To Use In 2022 Required In 2023 Wolters Kluwer

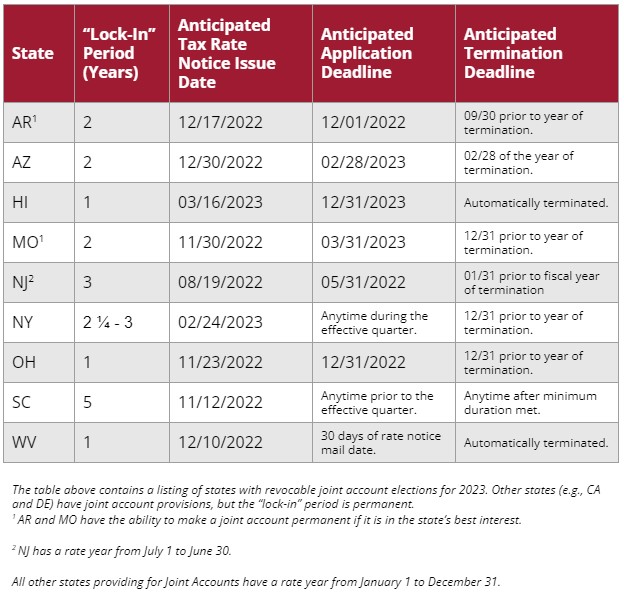

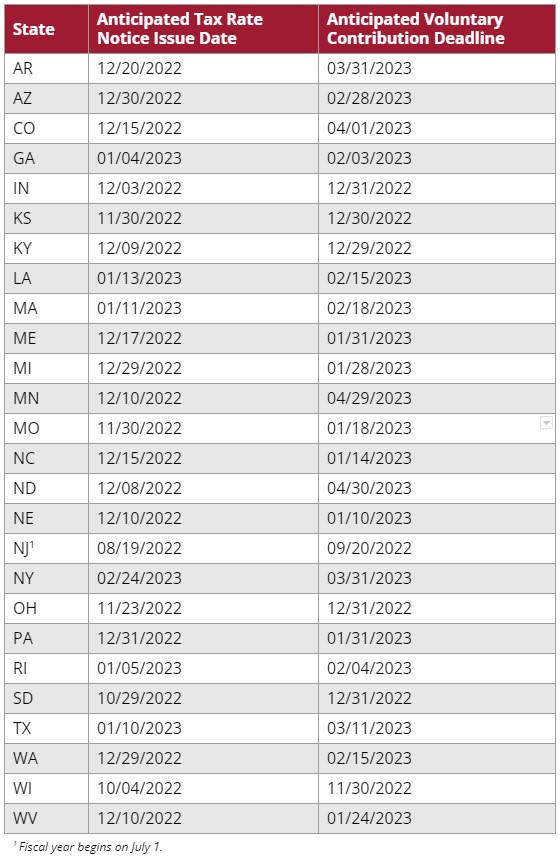

Planning Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

Planning Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

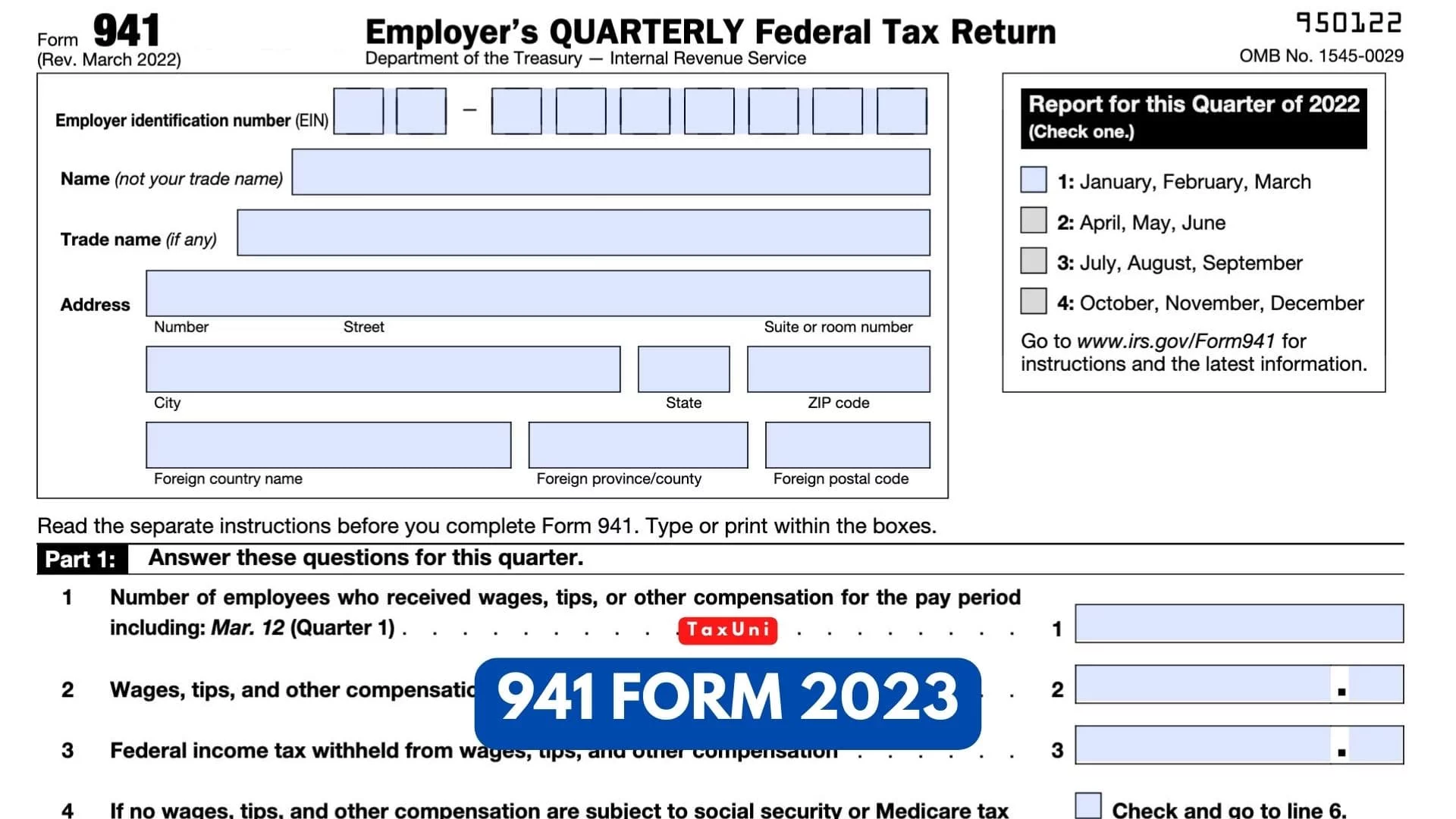

941 Form 2023

Comments On New York City S Executive Budget For Fiscal Year 2023 And Financial Plan For Fiscal Years 2022 2026 Office Of The New York City Comptroller Brad Lander

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Social Security What Is The Wage Base For 2023 Gobankingrates

Form 941 For 2023

Who S Ready For 6 Big Changes To Social Security In 2023 The Motley Fool

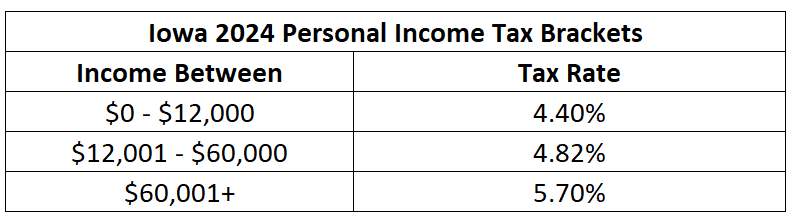

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

The 1 Social Security Change You Can Bank On For 2023 The Motley Fool

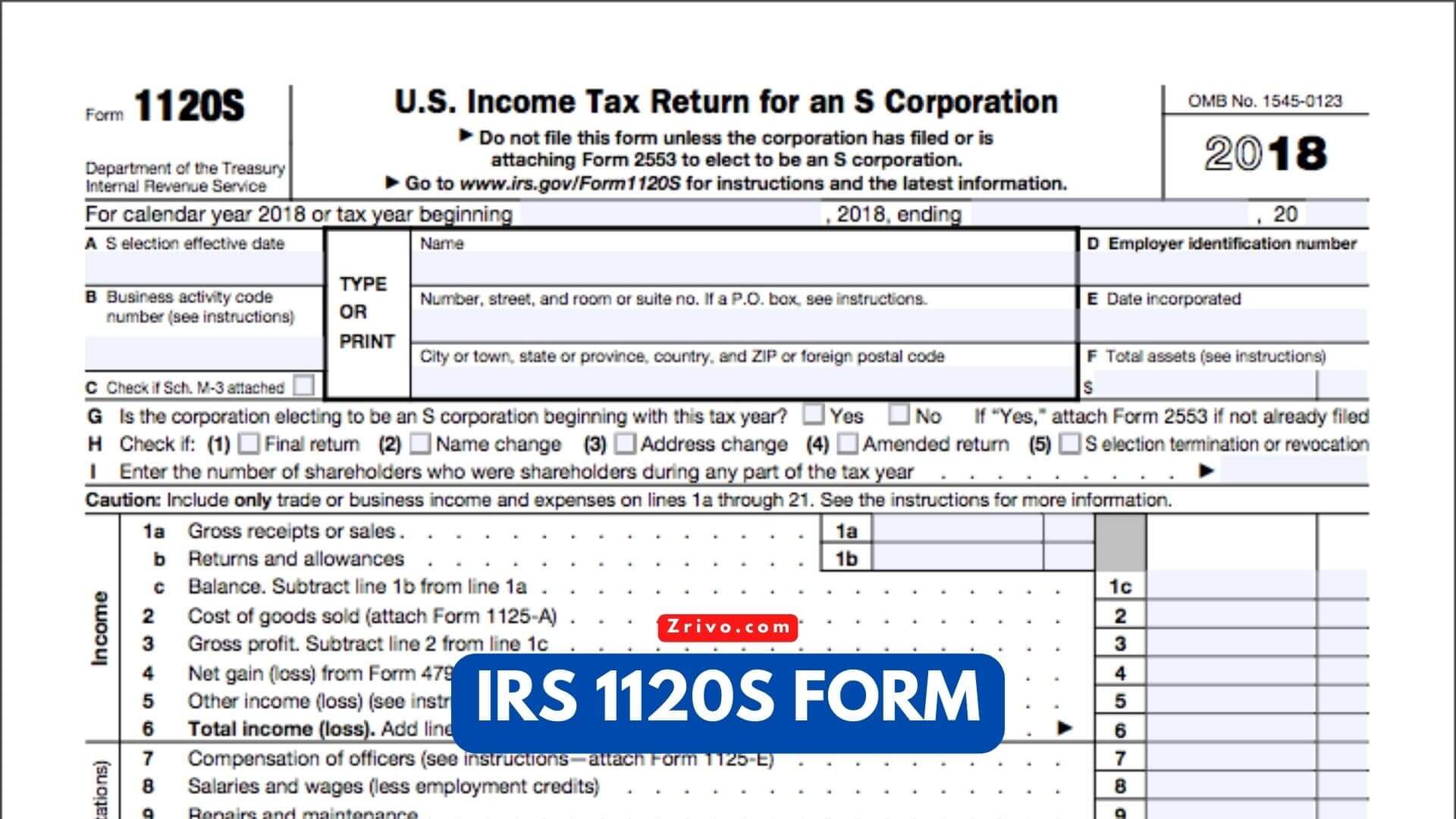

1120s Form 2022 2023

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company